Bitcoin has rebounded despite low trading volumes, weak cryptocurrency prices, and challenging economic conditions. In October, after a summer without wind, it even found another one.

2023 has been the year of healing for Bitcoin, after 2022 being quite a tough and broke year .

“The recovery has been good, but we’re just at the beginning of a new cycle,” said Kevin Koh, managing partner and co-founder of the investment firm Spartan Group.

With a 164% increase since January 1st, the cryptocurrency market leader is now trading above $40,000. It has outperformed conventional assets, such as the S&P 500, which has gained 20%, and gold, which has increased by 10%.

According to CoinGecko data, Bitcoin also boosted its market share from 38% to over 50% of all cryptocurrencies. By the end of 2022, the total value of the cryptocurrency industry had grown to $1.7 trillion from $871 billion.

A large portion of bitcoin’s gains occurred later in the year when investor interest was revived by the prospect of a looser monetary policy and a possible U.S. spot bitcoin exchange-traded fund (ETF).

The aggregate spot and derivatives trading volume on centralized exchanges reached $3.61 trillion in November, up from roughly $2.9 trillion in January, indicating that trade volumes have also increased as reported by CCData.

Stablecoins, or cryptocurrencies whose value is linked to a physical object like the dollar, have also increased in parallel. The biggest of these coins, Tether, has seen its market capitalization jump to an all-time high of more over $90 billion.

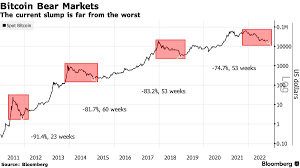

The 2022 Downfall

After a torrid 2022 saw the downfall of FTX and Sam Bankman-Fried, 2023 has seen more crypto giants come a cropper.

Binance chief Changpeng Zhao, plead guilty to breaking U.S. anti-money laundering laws, most notably, part of a multi-billion dollar settlement with regulators. The co-founder of Voyager Digital also found himself on the wrong end of American regulatory action, while Celsius founder Alex Mashinsky was arrested in the U.S. in July, pleading not guilty to criminal counts including security fraud.

Last but not least, SBF was found guilty of fraud in November following a fast-paced trial. Conversely, the XRP token issued by Ripple had gains of 82% for the year following a significant ruling by a US judge that cleared the industry of securities law violations regarding the token’s sales by Ripple Labs on open exchanges.

What lies ahead for Bitcoin?

The majority of the 55% surge in bitcoin during the fourth quarter has been ascribed to wagers that a bitcoin ETF will be authorized in the United States, attracting capital from both individual and institutional investors due to the simplicity of obtaining exposure to the virtual asset on a regulated stock market.

The U.S. Securities and Exchange Commission has received proposals from 13 organizations, including multibillionaire asset management firms Fidelity and BlackRock, for the multibillion dollar product.

Investors are predicted to contribute as much as US$3 billion to this fund in the first few trading days, and then billions more.

Although the broader market is pricing in a rather high level of adoption success, JPMorgan predicts that the crypto market rebound will last until the anticipated approval in early 2024.

According to JPM, the bitcoin ETFs should attract assets within the low to mid-single digit percentage range of the US$1.7 trillion cryptocurrency market, as opposed to some bullish outlooks of 10%.

Crypto markets might undo their recent gains if adoption doesn’t meet investor expectations, which are estimated to be about 10%.

According to analytics company Glassnode, the net dollar-denominated realized profit locked in by bitcoin investors has reached US$324 million every day. This is still significantly less than the peaks attained during the middle stages of the 2021 bull market, when US$3 billion was made every day.

What is Bitcoin or BTC?

It is the first extensively used cryptocurrency in history. People can send digital money to each other instantly and securely over the internet with Bitcoin.

A group of people going by the pseudonym Satoshi Nakamoto developed Bitcoin, publishing a white paper outlining the concept in 2008. The idea behind bitcoin is enticingly straightforward: it’s digital currency that enables safe peer-to-peer online transactions.

Bitcoin is decentralized; any two people, anywhere in the world, can send bitcoin to each other without the help of a bank, government, or other institution. This is in contrast to services like Venmo and PayPal, which depend on the traditional financial system for permission to transfer money and on existing debit/credit accounts.

The blockchain, which is comparable to a bank’s ledger or log of clients’ money coming in and going out, records every Bitcoin transaction. It is, to put it simply, a record of every bitcoin transaction ever made.

The Bitcoin blockchain is spread throughout the network, in contrast to a bank’s ledger. It is not governed by any one organization, nation, or other entity, and anybody is welcome to join the network.

21 million bitcoins are all that will ever exist. It is impossible to inflate or manipulate this digital currency in any manner. Purchasing a whole bitcoin is not required; if that’s all you need or want, you can purchase a smaller portion of it.

Comments 1