The Adani Group found solace in the Supreme Court verdict on Wednesday at 10:30 a.m., which pronounced its decision on a number of petitions pertaining to the Adani-Hindenburg dispute. The verdict allowed the Adani group firms’ stocks to hold onto their early gains in the event of a favorable ruling.

The Supreme Court dismissed the use of the OCCPR report and any other third-party organization, stating that unverified reports of this kind cannot be accepted as evidence.

According to the Supreme Court, market regulator SEBI has been instructed to resolve the remaining two cases within a three-month period, after the market regulator concluded its investigation into 22 of the 24 claims. However, the verdict denies transferring the case to Special-Investigation Team (SIT).

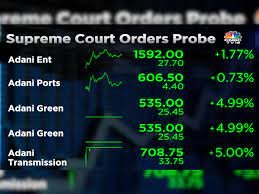

Adani Stock Surge 10%

The Company’s stocks stirred up to 10% ahead of the Supreme Court decision today.

Adani’s Wilmar Ltd, Power Ltd, Enterprises Ltd, Total Gas Ltd, Green Energy Ltd, Ports & Special Economic Zone Ltd (Adani Ports), Energy Solutions Ltd, and Enterprises Ltd all saw gains of up to 10%. NDTV Ltd, ACC Ltd, and Ambuja Cements Ltd all leaped as well. This cleared the Rs 15 lakh crore threshold for the group’s market capitalization (m-cap).

Comparatively speaking, the group’s previous session’s m-cap level was Rs 14.46 lakh crore. The market value of Rs 19.2 lakh crore that ten of the same listed group companies commanded on the day Hindenburg Research released its damning analysis last year is still far away from this.

Moreover, other Adani-owned businesses saw gains as well. For example, NDTV increased 10.21% to Rs 300, ACC shares increased 2.64 percent, and Ambuja Cement had a 3.13 percent increase.

Highlights of the Adani-Hidenburg Case

Today the SC recommended against considering the Hindenburg Research study to be “a statement of truth.” It implied that the court could not base its decision to reject the market regulator SEBI’s investigation into the matter on a small number of media stories.

Three-judge panel considering the Adani-Hindenburg case, led by Chief Justice DY Chandrachud and Justices JB Pardiwala and Manoj Misra, had reserved the verdict until November 2023.

“What is said in the Hindenburg report does not necessarily imply that things are as they are. We instructed the SEBI to look into this. Since we lack the tools to verify the truth of the information in the report of an entity that is not before us, accepting it would be extremely unfair, the bench recently informed lawyer Prashant Bhushan, who was representing one of the petitioners.

The plummeting price in the company shares last year was caused by the US-based short-seller Hindenburg Research, which in January 2023 accused Gautam Adani’s group of “stock manipulation” and indicated “brazen accounting fraud” in group firms.

Comments 2