Alphabet has joined the list of tech gaints, including Apple, Meta and Microsoft, that pay dividends to their shareholders. It rolled out the announcement during its latest quarterly result, which had estimates exceeding analyst’s expectations. The Q1 result projected a mammoth revenue at $80.54 bn for the search-company and net income at $23.66 bn.

Once the news was out, Alphabet stocks surged by 14% throwing its investors into a frenzy. The dividend program will return 20% of its revenue earned to its share-holders, with first payment on June 17, as the record closes on June 10.

Result highlights

The numbers– Alphabet reported a 15% jump in revenue from the previous year. In 2023, the company’s revenue was at $69.79 billion, operating margin at 25% and diluted EPS at $1.17 per share. In 2024, the search giant surprised the market analysts that predicted their Q1 results with its performance. While the yearly revenue estimates were at $78.8 billion, the actual data reported a mammoth figure of $80.54 billion, in which Google advertising alone generated $61.6 billion revenue. The operating margin also jumped by 7% and diluted EPS rested at $1.79 per share.

Number of Employees– As of March 2023, the company had 190,711 individuals working under it. Currently, it has been reduced to 180,895 indicating almost 10k layoffs in a year.

AI team consolidation – Alphabet has taken a big step to ramp up progress in the field of AI and catch up with its rival giants, Meta and Apple. AI model development teams previously under Google Research in our Google Services segment will be included as part of Google DeepMind, reported within Alphabet-level activities, prospectively beginning in the second quarter of 2024; the report stated.

Dividend Program– Alphabet board of directors have approved a cash dividend program and a cash dividend of $0.20 per share will be paid to its investors on June 10, 2024 of record as of June 10, 2024 on company’s Class A, B and C each. The company plans to pay quarterly cash dividends which are subject to review and approval by the company’s Board of Directors in its sole discretion.

Stock Repurchases– In another big decision, the company can now repurchase stocks upto $70 billion from Class A and Class C shares in the best interest of the company and its shareholders, considering the economic cost and prevailing market conditions of these classes of shares.

Also Read: Apple to host let loose event on May 7

Impact on the Shares market

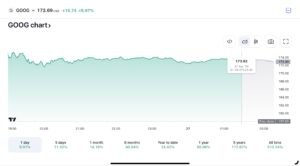

After the report was made public, Alphabet shares skyrocketed 14.3% in extended trading to $173.62 as of 1:29 a.m. IST, April 27. The company market cap hit a $2 trillion mark in the process, making an exceptional achievement.

Trading world in Europe and the US saw significant improvement due to Alphabet’s great numbers. US based stocks S&P 500, NASDAQ Composite and Dow Jones Industrial gained momentum by 1%, 2% and 0.39% respectively as on April 26, 9:30 pm IST. Meanwhile European stock DAX led the gains by 1.36%.